If you’re searching robert kiyosaki net worth, you’re probably trying to figure out one thing: how wealthy is the Rich Dad Poor Dad author in real life? The honest answer is that his net worth isn’t a clean, verified number because most of his wealth is tied to private businesses, real estate, and investments that fluctuate.

Still, based on the most commonly repeated estimates and what you can reasonably infer from his business model, Robert Kiyosaki’s net worth in 2026 is best described as a high eight-figure to low nine-figure range—often discussed around $100 million to $160 million. Some sources claim higher, but that usually depends on aggressive assumptions about private assets and market timing.

Quick Facts About Robert Kiyosaki

- Full name: Robert Toru Kiyosaki

- Known for: Author of Rich Dad Poor Dad, financial educator, entrepreneur

- Main brand: Rich Dad (books, courses, speaking, products)

- Primary money themes: Real estate, leverage (good debt), cash flow, alternative assets

- Why his net worth is debated: Private companies + real estate valuations + public “debt” talk

- Estimated net worth (2026): Commonly discussed around $100M–$160M

Robert Kiyosaki Net Worth In 2026 A Realistic Range

In 2026, Robert Kiyosaki’s net worth is most realistically placed in the $100 million to $160 million range. That range fits how his empire earns money and how people like him typically hold wealth: a mix of intellectual property (books), a powerful educational brand, and investment assets that rise and fall with markets.

You’ll sometimes see much higher numbers—hundreds of millions or even close to a billion. Those bigger claims usually come from one of two things:

- Counting “business value” at a premium without knowing what the company actually profits.

- Assuming real estate and investments are worth peak-market prices and ignoring debts or liabilities tied to leverage.

If you want a number that feels grounded in reality, it’s smarter to stick with a range that reflects both the strength of his brand and the uncertainty of private finances.

Why Robert Kiyosaki’s Net Worth Is So Hard To Pin Down

Unlike a celebrity with a public salary, Kiyosaki’s wealth is mostly private and variable. And he’s not shy about using leverage, which makes net worth conversations messier than usual.

Here are the biggest reasons his “net worth” looks different everywhere you search:

- Private companies don’t publish clean financials. You can’t easily verify profits, ownership splits, or valuations.

- Real estate values swing. If he owns multiple properties, small market changes can move net worth by millions.

- Debt can be strategic. Kiyosaki openly talks about using debt to buy assets. That means large assets can sit next to large liabilities.

- People confuse revenue with wealth. A brand can generate huge revenue while profit is far smaller after costs and taxes.

- He’s a “story” brand. When someone teaches money, the internet tends to exaggerate their wealth as proof they’re right.

So if you’ve seen wildly different net worth estimates, don’t assume you’re missing a secret. You’re seeing guesswork applied to private assets.

How Robert Kiyosaki Actually Makes Money

Kiyosaki didn’t build his fortune from one book alone. He built a brand that keeps selling, then used that brand to fuel a wider business ecosystem. Think of it like a hub-and-spoke model: the book is the hub, and everything else spins off it.

1 Book Royalties And Publishing Income

Rich Dad Poor Dad is the foundation. It’s one of those books that doesn’t just sell—it keeps selling. That “evergreen” effect matters because it creates long-term income without needing a new product every year.

His publishing income likely comes from multiple buckets:

- royalties from ongoing sales of the main book

- royalties from related Rich Dad titles

- foreign rights and international editions

- audiobooks and digital formats

Even if the book’s peak sales were years ago, the back catalog can still generate serious annual income when the brand stays in constant conversation online.

2 The Rich Dad Brand And Education Business

This is where his wealth-building model becomes clearer. Kiyosaki isn’t just an author—he’s a brand operator. The Rich Dad name has been attached to educational products and experiences that monetize the desire people have to “learn money the way schools don’t teach it.”

Depending on the structure and partners involved, the Rich Dad ecosystem can include:

- paid seminars and live events

- online courses and training products

- coaching-style programs

- paid memberships or premium content

This category is powerful because it scales. A book sells one copy at a time, but education programs can generate higher revenue per customer—especially when the audience is highly motivated.

3 Speaking Engagements And Media Appearances

Public speaking is a major wealth engine for many business authors. When you become a recognizable authority, companies and event organizers pay for access to your name.

Kiyosaki has remained visible through interviews, commentary, and frequent public opinions on markets. That visibility helps him in two ways:

- It keeps the Rich Dad brand alive, which supports book and course sales.

- It positions him as a premium speaker, which can command high fees.

Speaking income isn’t always steady like royalties, but it can be extremely profitable when demand is high.

4 CASHFLOW Game And Product Revenue

One of Kiyosaki’s smartest moves was turning his philosophy into a product: the CASHFLOW game. Products like this do something a book can’t—they create an experience people share, recommend, and buy as a gift.

Over time, product revenue can add up through:

- direct sales

- bundles with courses

- corporate and group training usage

- online marketplace distribution

It’s not necessarily the biggest slice compared to real estate, but it’s an “owned” revenue stream that strengthens his brand.

5 Real Estate Investments

Real estate is central to Kiyosaki’s public philosophy, and it’s widely believed to be a major part of his personal portfolio. Here’s why real estate matters so much to net worth:

- It can create monthly cash flow (rent minus expenses).

- It can appreciate over time.

- It can be leveraged (using debt to control larger assets).

But it also explains why net worth estimates vary. If someone owns significant real estate with loans attached, the “asset value” might be huge while the “net value” depends on how much debt is still tied to those properties.

This is also why you’ll see debates online about whether he’s worth $100M or far more. People who focus on asset values alone will get bigger numbers. People who account for leverage will land lower.

6 Alternative Assets And Market Bets

Kiyosaki is known for strong opinions about traditional money systems and for promoting “hard assets” and alternative investments. If he’s consistently invested in assets like precious metals or other alternative categories, that can add volatility to his net worth—up or down—depending on market cycles.

This matters because his wealth may fluctuate more than the average author’s. He isn’t just sitting on book royalties. He appears to think like an investor, and investors ride cycles.

The “Debt” Conversation And Why It Doesn’t Automatically Mean He’s Broke

You’ll often see people bring up Kiyosaki and debt in the same sentence. Sometimes it’s framed as a “gotcha,” like, “How can he be rich if he has debt?”

But in real estate and business, debt can be a tool. Here’s the simple difference:

- Bad debt usually buys things that lose value or don’t produce income.

- Strategic debt is often used to buy assets that can pay for themselves (like rental property).

So it’s completely possible for someone to hold significant debt and still be very wealthy—if the assets financed by that debt are producing income and holding value.

What Could Push Robert Kiyosaki’s Net Worth Higher Or Lower?

Because he’s tied to markets and a business brand, his net worth isn’t “locked.” It moves with conditions. Here are the biggest levers:

- Real estate market swings: property values and interest rates can change net worth quickly.

- Course and seminar demand: economic uncertainty often boosts interest in financial education.

- Brand reputation cycles: controversy can hurt partnerships, while renewed popularity can spike sales.

- Investment performance: alternative assets can rise sharply—or fall sharply.

That’s why a range makes more sense than a single number.

The Bottom Line

So, robert kiyosaki net worth in 2026 is best described as a high eight-figure to low nine-figure fortune, most commonly estimated around $100 million to $160 million. He built it through a long-running book empire, the Rich Dad education brand, speaking and products, and a portfolio that likely includes real estate and alternative investments.

If you want the simplest takeaway: Kiyosaki’s wealth is less about one bestselling book and more about building a financial-education machine that keeps earning—then investing those earnings into assets that can grow over time.

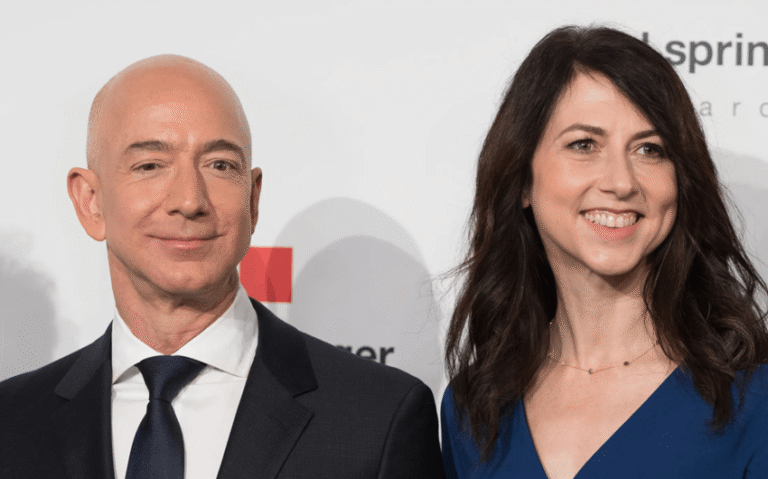

Featured image source: https://www.inkl.com/news/5-questions-successful-people-ask-themselves-according-to-rich-dad-robert-kiyosaki