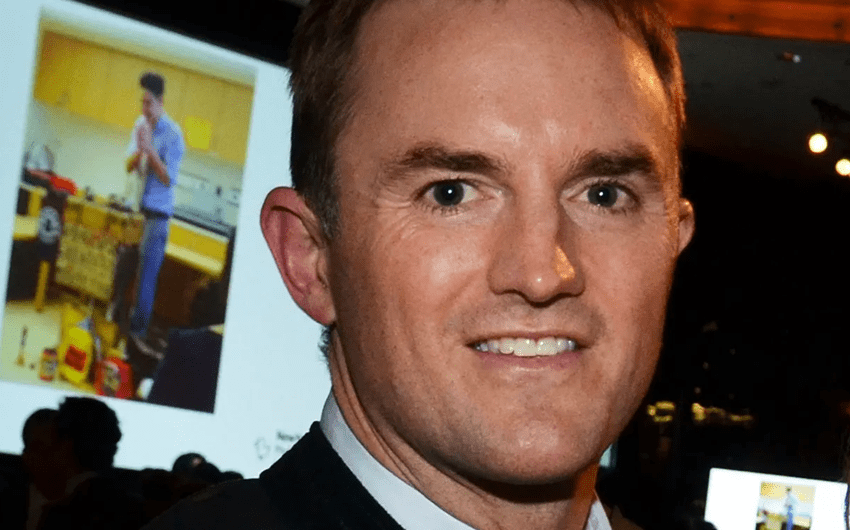

Chase Coleman is one of the most influential investors of the last two decades, yet he remains largely unknown outside financial circles. Unlike celebrity CEOs or outspoken billionaires, Coleman has built his wealth quietly through hedge fund investing, private technology bets, and long-term capital compounding. This naturally leads to one core question: what is Chase Coleman’s net worth? While exact numbers fluctuate with markets, Chase Coleman’s net worth is firmly in the multi-billion-dollar range. More importantly, his wealth is a case study in how modern finance, technology investing, and disciplined reinvestment can create extraordinary fortunes over time.

Chase Coleman Net Worth Overview

Chase Coleman’s net worth is generally estimated to be several billion dollars, with most credible estimates placing him among the wealthiest hedge fund managers in the world. The precise figure changes year to year because his wealth is deeply tied to market performance, especially in technology stocks and private company valuations.

Unlike founders who monetize wealth through a single IPO or acquisition, Coleman’s fortune has been built incrementally. His net worth reflects decades of gains layered on top of one another: hedge fund fees, reinvested profits, personal capital appreciation, and ownership stakes in high-growth companies. This makes his wealth dynamic rather than static. In bull markets, particularly technology-driven ones, his net worth can rise by billions. In downturns, it can shrink just as dramatically on paper.

Despite these fluctuations, what matters most is scale and durability. Even after market corrections, Coleman remains extremely wealthy because his fortune rests on long-term compounding rather than short-term wins.

The Core of His Wealth: Tiger Global Management

The foundation of Chase Coleman’s net worth is Tiger Global Management, the investment firm he founded in 2001. Tiger Global is unique in that it combines a traditional hedge fund investing in public equities with an aggressive private investment arm focused on technology companies.

This structure is crucial to understanding how Coleman built his fortune. On the public side, Tiger Global invests in listed companies, often taking concentrated positions in high-growth technology stocks. On the private side, the firm invests in late-stage startups and private technology companies around the world. These private investments often appreciate significantly before any public exit occurs.

As founder and managing partner, Coleman earns wealth in multiple ways. He benefits from ownership in the firm itself, from management fees tied to assets under management, and from performance fees earned when investments generate profits. Over time, these revenue streams reinforce each other, accelerating his net worth growth.

Hedge Fund Fees and Long-Term Income Power

Hedge fund fees are one of the most powerful engines behind Chase Coleman’s net worth. Tiger Global historically charged management fees based on total assets under management, which provided a steady stream of income regardless of market conditions.

More significant, however, are performance fees. During periods when Tiger Global generated exceptional returns—especially during technology bull markets—performance fees alone produced enormous personal income for Coleman. In strong years, these fees reached into the hundreds of millions of dollars.

What separates Coleman from many others is how these earnings were used. Rather than treating fee income as disposable wealth, much of it was reinvested. By continuously recycling earnings back into investments, Coleman allowed compound growth to work over decades, not just years.

Personal Capital and Compounding at Scale

A defining feature of Chase Coleman’s wealth is how much of his own money he keeps invested. He does not simply manage other people’s capital; he invests heavily alongside his funds. This alignment means his personal net worth moves in tandem with Tiger Global’s success.

This structure creates powerful compounding. When investments perform well, Coleman benefits both from ownership gains and from performance fees. Over long periods, this double exposure dramatically magnifies results.

It also means his wealth is not primarily held in cash. Much of his net worth exists as equity stakes, fund ownership interests, and unrealized gains. While this reduces liquidity, it maximizes long-term growth potential.

The Central Role of Technology Investing

Technology investing is the single most important factor behind Chase Coleman’s rise in net worth. Tiger Global became known for identifying transformative technology companies earlier than many competitors and committing capital aggressively.

The firm invested in some of the most valuable technology companies in the world, including early and mid-stage investments in platforms that reshaped social media, payments, software, and global commerce. These investments often produced returns far exceeding traditional market averages.

Private technology investments were especially impactful. As startup valuations surged over the past decade, Tiger Global’s private portfolio grew enormously on paper. Because Coleman’s personal capital was tied to these investments, his net worth expanded alongside them—even before companies went public.

Net Worth Volatility and Market Cycles

Chase Coleman’s net worth is not immune to market downturns. Because his wealth is heavily concentrated in growth assets, particularly technology, market corrections can significantly reduce valuations.

During periods of rising interest rates or declining tech sentiment, public stock prices fall and private company valuations are marked down. When this happens, Coleman’s net worth can decline sharply on paper, sometimes by billions.

However, these declines must be viewed in context. They reflect valuation changes, not a reversal of decades of accumulated gains. Coleman’s long-term success means that even after major drawdowns, his net worth remains extraordinarily high.

Why Net Worth Estimates Differ So Widely

One reason Chase Coleman’s net worth is difficult to pin down is the nature of private assets. Unlike publicly traded stocks, private investments do not have daily market prices. Their valuations are based on funding rounds, comparable companies, and internal models.

Different analysts use different assumptions, leading to wide variation in reported net worth figures. Some estimates are conservative, others optimistic. What remains consistent is the conclusion that Coleman is a multi-billionaire whose wealth ranks among the top tier of global investors.

Wealth Structure and Financial Durability

Coleman’s net worth is structured for durability rather than visibility. His wealth is spread across fund ownership, reinvested profits, equity stakes, and long-term holdings rather than luxury assets or highly liquid cash.

This structure allows him to weather market cycles. Even when one segment underperforms, others continue to generate value. Combined with disciplined risk management and long-term focus, this approach supports sustained wealth preservation.

The Future of Chase Coleman’s Net Worth

The future trajectory of Chase Coleman’s net worth will largely depend on technology markets, innovation cycles, and private company exits. If technology valuations recover and growth resumes, his wealth could expand significantly again.

Even in slower growth environments, his diversified investment base and experience navigating cycles position him to remain among the most financially powerful investors of his generation.

Conclusion

Chase Coleman’s net worth is the result of disciplined investing, strategic risk-taking, and decades of compounding capital. Built primarily through Tiger Global Management, hedge fund fees, personal investment capital, and early exposure to transformative technology companies, his fortune has grown into the multi-billion-dollar range. While market downturns have caused fluctuations, the long-term financial reality remains clear: Chase Coleman is one of the most successful wealth builders in modern finance, and his net worth reflects patience, conviction, and the power of compounding at scale.