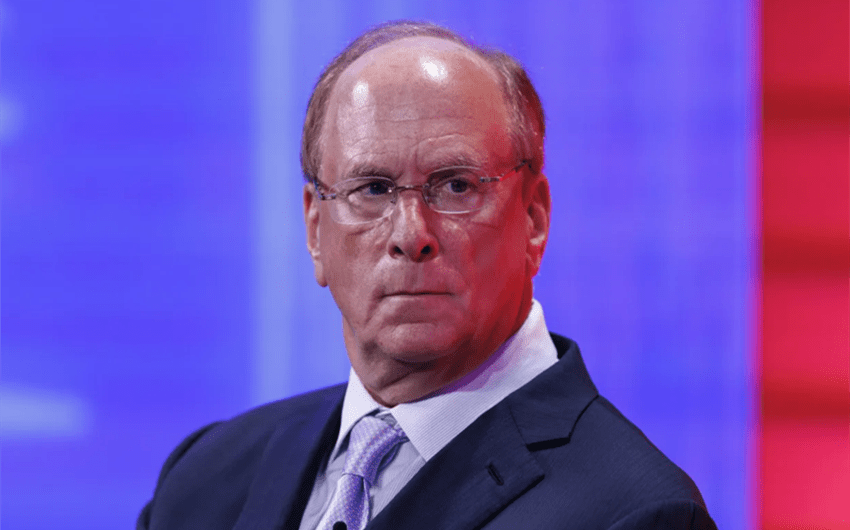

Larry Fink’s net worth gets talked about like it’s tied to the trillions BlackRock manages, but that’s not how personal wealth works. His fortune is real, and it’s large, yet it comes mostly from compensation and long-term ownership in BlackRock—not from personally “owning” client assets. Below is a practical estimate of Larry Fink’s net worth in 2025, plus the clearest public clues that explain where the money comes from and why different sites publish different numbers.

Larry Fink net worth estimate (2025)

Estimated net worth (2025): $1.2 billion

Estimated range: $1.0 billion to $1.4 billion

This estimate is based on the most common published range across multiple net worth trackers that place him around the low single-digit billions (often citing $1.1–$1.3B or about $1B+). Because there is no official public “net worth statement,” this should be treated as a best-fit estimate, not a certified figure.

Why people confuse Larry Fink’s wealth with BlackRock’s size

BlackRock is enormous, and the company’s scale can make headlines feel misleading. BlackRock’s proxy materials describe it as a global asset manager, and its 2025 proxy statement notes roughly $11.6 trillion of AUM at the end of 2024. That figure is client money under management, not Larry Fink’s personal bank account.

In simple terms, AUM is closer to “how much money clients trust your firm to manage” than “how much money the CEO has.” Larry Fink’s personal wealth is more directly tied to his compensation and his BlackRock stock holdings.

The biggest driver of his net worth: BlackRock stock

The clearest public window into Larry Fink’s personal wealth is his ownership of BlackRock shares. In BlackRock’s 2025 proxy statement, the “Ownership of BlackRock Common Stock” table lists Laurence D. Fink as beneficially owning 303,686 shares of BlackRock common stock (as of March 28, 2025, under SEC beneficial-ownership rules).

That matters because when you’re a founder/longtime CEO, your “real money” often sits in equity. Salaries are meaningful, but stock is what can turn an executive into a billionaire—especially if the company compounds in value over decades.

His annual pay is huge, but it’s not the whole story

Larry Fink’s compensation is often reported in the tens of millions, but it fluctuates based on company performance and how awards are structured. BlackRock’s 2024 proxy statement (covering fiscal year 2023 compensation tables) reports that the CEO’s annual total compensation for 2023 was $26,939,474. Reuters also summarized that his 2023 compensation totaled about $26.9 million and described changes BlackRock made to his pay structure tied to private markets growth.

That’s a staggering amount of income, but here’s the key point: billionaire status usually comes from equity value (stock and long-term awards), not just one year of paychecks. Even $25–35 million a year, after taxes and expenses, does not automatically become a billion dollars unless it’s paired with ownership growth over time.

How Larry Fink likely built a billion-dollar fortune

There are a few straightforward building blocks that fit the public record of how large-company CEOs accumulate wealth.

1) Founder advantage and decades-long equity compounding

Larry Fink co-founded BlackRock and stayed at the top for decades. When a company grows for that long, early equity becomes incredibly powerful. The proxy ownership table confirms he holds a meaningful personal stake, and that stake rises and falls with BlackRock’s share price.

2) Stock-based compensation and performance awards

Public company proxy statements show that CEO compensation is rarely “just salary.” It often includes stock awards and performance-based option grants. Those can be worth a lot when granted, and even more when they vest and the stock performs well.

3) Cash compensation and bonuses

Cash pay is still a real part of the story. A multi-decade career of top-tier compensation builds capital that can be invested elsewhere—real estate, diversified portfolios, private funds, and long-term vehicles that don’t show up in a quick Google result.

4) The “private markets” shift and carried interest

In 2025 reporting, Reuters noted BlackRock tied aspects of Fink’s pay to its expansion into private markets and introduced carried interest into his compensation structure, tied to performance profits from private-market funds. That signals a modern executive-pay reality: as firms push deeper into alternatives, executives can be rewarded with incentives that resemble private-equity economics.

Whether that meaningfully increases his net worth long-term depends on performance and vesting, but it explains why people expect his wealth to keep rising if BlackRock’s private-markets expansion succeeds.

Why online net worth numbers vary so much

Even though Larry Fink is a high-profile business leader, net worth estimates still jump around. Here’s why:

- Not all sites value equity the same way. Some use older share counts, some use stale prices, and some guess at unvested awards.

- Many estimates don’t separate “owned” vs. “can acquire.” SEC beneficial ownership can include shares someone has the right to acquire within 60 days, which can confuse casual readers.

- Compensation headlines get mistaken for net worth. “He made $30 million” is not the same as “he is worth $30 million.”

- Forbes-style lists may be paywalled or summarized. People repeat secondhand numbers, and the figure gets distorted in the reposting.

That’s why a range is more honest than pretending there’s one perfect number. Still, the repeated “around $1B to $1.3B” consensus is a strong signal that the low-billions estimate is the best fit.

What his BlackRock stake suggests in plain English

Based on BlackRock’s own proxy statement, we can say something simple and defensible: Larry Fink owns hundreds of thousands of shares of BlackRock stock. At modern BlackRock share prices, that alone can represent a very large amount of wealth, before you even consider other investments, deferred compensation, or past stock awards.

And because he is the CEO of a large public company, it’s reasonable to assume his total financial picture includes diversified assets as well—though those assets are not publicly itemized the way corporate shares are.

Does Larry Fink really have “billionaire” status?

Yes, in the practical sense that multiple estimates place him at or above the billionaire threshold. Some trackers put him around $1 billion, while others put him closer to $1.3 billion. The best-fit estimate of $1.2 billion splits the difference and matches the most commonly repeated band.

It’s also consistent with what you’d expect from: (1) a co-founder/CEO of a major firm, (2) decades of equity growth, and (3) executive compensation measured in the tens of millions.

Common myths that show up in “Larry Fink net worth” searches

Because BlackRock is so large, a few myths circulate constantly.

Myth: “He personally owns the $11+ trillion.”

No. AUM is client money. BlackRock earns fees for managing it, and Larry Fink benefits because he owns shares in BlackRock and is paid to lead it. But he does not personally own client assets under management.

Myth: “His wealth is secret because it’s all hidden.”

Not exactly. The core pieces that matter—executive compensation disclosures and stock ownership—are partially visible through proxy statements and SEC filings. What’s private is the rest of his household balance sheet (private investments, real estate, trusts, and other holdings), which is normal for private citizens.

What could push his net worth higher or lower from here?

Net worth at this level is heavily market-driven. A few factors tend to matter most:

- BlackRock stock performance: If the share price rises materially, his equity value rises with it.

- Private-markets incentives: If carried-interest style incentives pay out strongly over time, that can add meaningful upside.

- Stock sales and diversification: Executives sometimes sell shares for diversification, taxes, or estate planning. Those moves can change “paper wealth” without meaning the person is suddenly poorer.

- Market cycles: Asset managers are exposed to market downturns because AUM and fee revenue can fall when markets fall.

So while $1.2 billion is a reasonable 2025 estimate, it is not “fixed.” It can move with BlackRock’s valuation and with how his compensation packages vest and pay out.

Final answer: Larry Fink’s net worth in 2025

Larry Fink’s net worth is estimated at about $1.2 billion in 2025, with a reasonable range of $1.0 billion to $1.4 billion. The strongest public clues behind that estimate are BlackRock’s own proxy disclosures showing his stock ownership, plus compensation reporting that places his annual pay in the tens of millions and increasingly tied to private-markets performance.

image source: https://fortune.com/2025/06/06/blackrock-ceo-larry-fink-leadership-advice-social-media/